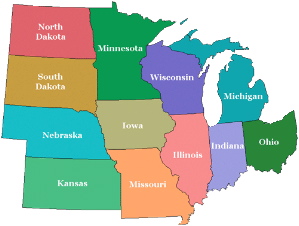

Caught a great front page article in the August 7 issue of Network World: “Middle of Nowhere: The burden of the Midwestern network start-up”. Ah, yes, the incredible burden of being in the sticks. Something we know a lot about here in Minnesota (even though we live in the one of the top 15 metro markets in the country, very often ranked as one of the best places to live and work). Writer Carolyn Duffy Marsan picked up a lot of nuances in this piece, which is based largely on looking at the stats for the 12 states considered “Midwest” from the latest PwC MoneyTree report. [Note: most of the examples she cites are in Ohio, but the article is instructive for any Midwestern startup.]

The biggest news was that Minnesota got a #2 ranking. But don’t look for that in the online version linked above; it’s in a sidebar that appears only in the print version. This sidebar ranked VC funds received by the 12 Midwestern states so far in 2006 (only for “network startups,” considering the focus of this publication). Minnesota, at $32M, was second only to Illinois, at $44M. The next closest, Wisconsin, was way down the list at only $7 million. A pretty solid ranking for the Land of 10,000 Lakes. Actually, there are at least 15,000 lakes here, and we border on the largest one in the world, but I digress…

A few stats from the article: there have been only 25 network startups in the Midwest to sign venture deals so far in 2006, compared to 822 nationwide (of which California alone had 371). The average deal size in the Midwest was $3.7 million. compared to $7.7 million for deals in California, Massachusetts, and Texas, the three leading states for network startups. [According to the aforementioned sidebar, however, Minnesota’s average so far this year is a heady $8 million.]

As more proof that those on the coasts don’t get it when it comes to the heart of the country, Tracy Lefteroff, managing partner of PwC’s VC practice in San Jose, was quoted as saying. “They have research institutions. They don’t have the venture capital and the experienced entrepreneurs to help build those companies.” Wrong on the last two counts, Tracy: we have plenty of entrepreneurs who’ve done it before and are not about to move elsewhere. And we have tons of VC money, too; the firms just choose to invest it elsewhere while giving lip service to how wonderful Minnesota is! [Sorry, my Minnesota VC friends — couldn’t resist.] Lefteroff goes on to say, “The first thing a venture firm will do if it’s investing in a Midwest startup is to move the company.” Wrong again, oh California one. There have been many notable tech startups funded here in recent times that have no intention of moving: HotGigs and Jumpnode (per my previous post), Travanti Pharma, and such other earlier notables as Paisley Consulting and Compellent. Smart VCs from elsewhere are discovering Minnesota, and startups here are discovering ways to go find them, and I think that’s very encouraging. Okay, so our locally based VC funds keep going where they think the grass is greener…let em go. It’s a national market.

The article mentions PrairieGold Venture Partners in Sioux Falls, SD, which still likes the Midwest, although they focus only on investments of less than $2 million. Partner Paul Batcheller says, “Life here tends to be a little easier. For a focused entrepreneur who doesn’t want to deal with traffic, high competition for talent, and expensive cost structures, there are a lot of advantages of doing business in the Midwest. Companies tend to be more focused. Employees tend to be more loyal.”

Another Midwesterner quoted in the article, who’s also worked in Silicon Valley, was Jeff Mills, VP-channel development for Bluespring Software in Cincinnati: “We’re much more grounded here in the Midwest. The venture capital community is tougher on us from the standpoint of due diligence vs. more faith on the coasts. The advantage is that we’re selling less vaporware here.”

Take that, rest of the world! 🙂

Leave a Reply